Incentives for Heavy Industry Decarbonization

By Pete Rocha, LEC Partners

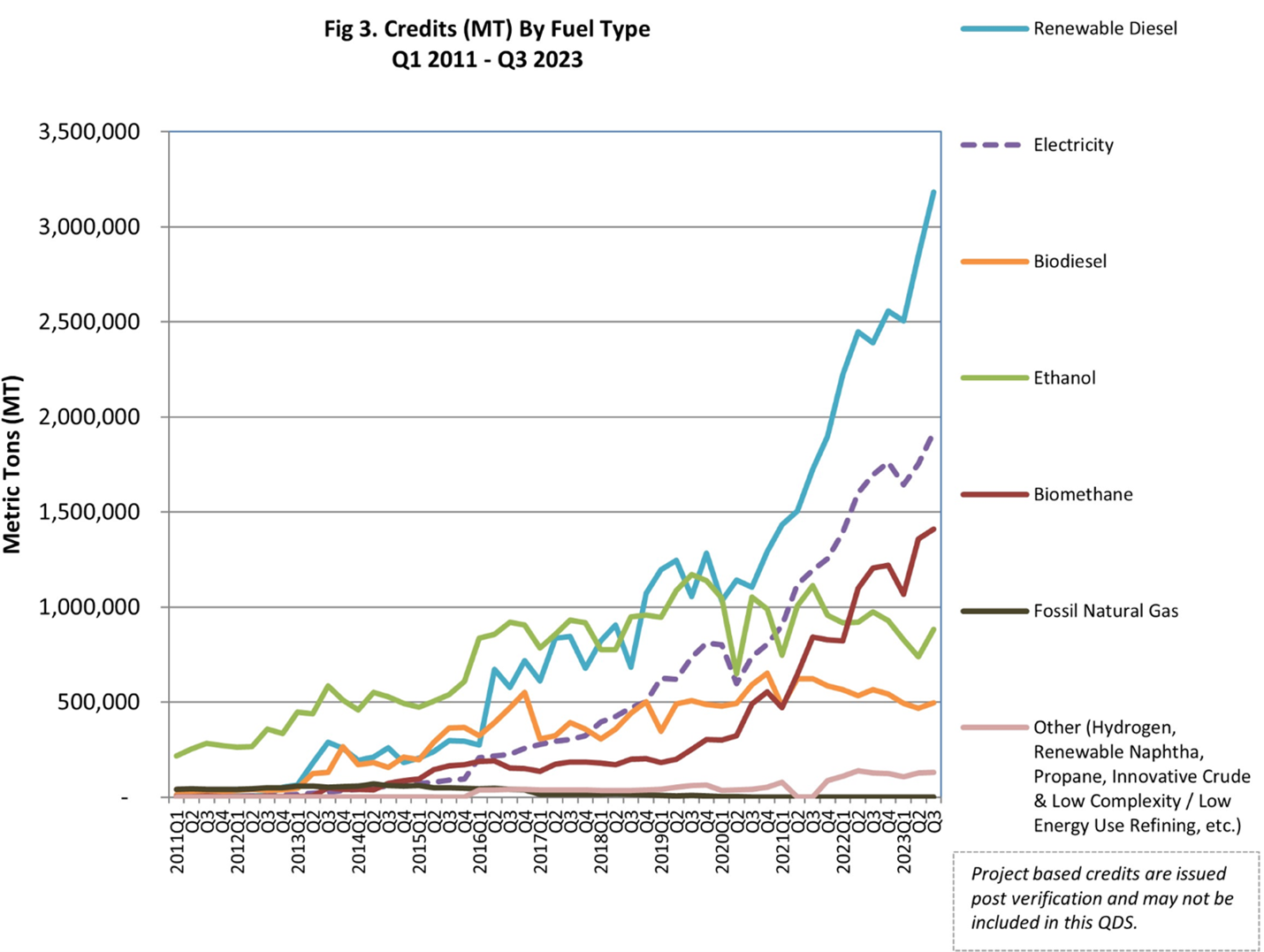

The Success of Renewable Diesel in California

The growth of renewable diesel (RD) in California is one of the great decarbonization success stories. In a decade, from 2013 through the end of 2022, the volume of RD consumed in California grew by over 1000% (see figure below). Less than half of California’s diesel use is supplied by petroleum, and petroleum diesel use could be phased out entirely in the next decade. This is a tremendous win in terms of carbon reduction and air quality. This success story begs the question, how was this massive reshaping of the transportation sector achieved, and what lessons can be applied to other sectors, like heavy industry?

Source: California Air Resources Board

The Role of the LCFS

The implementation of the California Low Carbon Fuel Standard (LCFS) is a clear indication of the growth of RD. The LCFS is a program that specifies that all transportation fuels must meet a specified carbon intensity. Fuels (like renewable diesel) below the target create a credit, and petroleum fuels above the target create deficits. Petroleum refiners, importers, and wholesalers are Regulated Parties under the LCFS, who create deficits when they introduce high-carbon fuels into the transportation system. This creates demand for low-carbon fuels, which are needed to balance the system to meet the overall carbon target, which becomes more stringent over time.

One important detail in understanding the success of the LCFS is that credits do not expire; they can simply be banked for use at a future time. This mechanism is much more effective than alternative regulatory schemes. In systems with flat percentage mandates, or expiring credits, there is uncertainty for producers, because as the market approaches the limit, they are unsure if the next gallon of fuel they will produce will receive the credit. And where there is uncertainty about what quantity is economical to produce, there is likely to be underinvestment in production assets or underutilization of existing capacity. Creating long-term stable demand for credits increases supply and allows for much more rapid decarbonization.

Lessons for Heavy Industry Incentives

So how do the lessons of the LCFS and renewable diesel apply to heavy industry decarbonization? It’s important to note from the case study that the incentives provided under the LCFS program addressed the demand side of the equation. Providing incentives to produce low-carbon alternatives will increase supply, but doesn’t ensure a functioning market is created. For heavy industries like steel and cement, green hydrogen is the analog to renewable diesel. These industries cannot be electrified and will require low-carbon hydrogen to meet their decarbonization objectives. While the current IRA 45V tax credit will help spur the supply of green hydrogen, it does nothing to ensure that the hydrogen will go to the industries where it is most needed.

Low Carbon Steel Standard

Imagine a regulatory mechanism for the green steel market with a similar structure to the LCFS. Steel producers using coal for iron reduction would become regulated parties, and fossil-based steel supplied to the market would incur a deficit. Steel producers using green hydrogen could then produce lower-carbon steel to generate credits and reduce emissions. In the early stages, there would be far more deficits than credits created, but that would provide further incentive for investment in hydrogen for green steel. Projects would be more secure if the market mechanism for low-carbon steel was secured by a long-term incentive program.

The Takeaway

The case history of the LCFS, and renewable diesel specifically, demonstrates that rapid decarbonization is possible. However, this success required not only regulation, but the proper incentive structure. Investors and project developers should understand not only what incentives are in place for green hydrogen projects, but also how the structure of those incentives impacts the success in creating a market for low-carbon products from heavy industries.

LEC Partners

LEC Partners has over 180 experts that can help navigate your bioeconomy needs. If you need assistance with your bioeconomy project(s), please Contact Us.

Have some questions?

Not sure where to start?

Let's start a conversation. We're here to help you navigate

the bioeconomy with confidence.