2020 Cannabis Ballot Measures

By Martin Wahl, Vice President, Lee Enterprises Consulting

This is the first in a series of articles being prepared by Lee Enterprises Consulting experts addressing opportunities and concerns for the growing hemp and cannabis industries. Topics will include cultivation, feedstock management, project financing, offtake agreement processing and product development with a focus on scaling up resulting from expanded production to meet the growing demand likely through accelerated mergers and acquisitions in addition to investment in new entities.

Investment in the cannabis sector dried up earlier this year in response to the Covid pandemic, and pent-up demand will likely be unleashed in 2021. Per Veridian’s Cannabis Deal Tracker, total capital raised by end of 3Q20, $2.9B, pales in comparison to 2019’s $10.5B. The industry has suffered capital starvation throughout 2020, despite increased consumer-level demand during the pandemic, and the nation is replete with M&A/acquisition targets. Investors will likely be cautious, however, seeking risk-mitigated opportunities, likely including more sophisticated technology and operations to support scaled-up production.

In the hemp sector, early entrants flooded the market with production creating a similar opportunity based on the fallout of participants resulting from plummeting CBD prices. Meanwhile, the hemp (non-psychoactive) consumer sector is off and running following the delisting of <.3%THC cannabis/hemp from DEA Schedule 1 and the inclusion of hemp support in the 2018 Farm Bill. According to Research and Markets, the global hemp market is expected to grow from $967.2M in 2020 to $5.3B by 2025. Grand View Research predicts the legal cannabis (where THC> .3%) market will grow from $22.9B in 2020 to $73.6B in 2027.

That’s fine for long-term planning, now let’s take a look at where the ballot action is going to be this November.

Cannabis legalization measures are on the ballot in states with a total population of over 21 million – that could bring the US population in cannabis-legal states to more than 312 million – more than 95% of the total US.

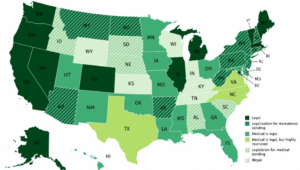

Here’s a map showing cannabis legality and pending legislation by state provided by GreenState.com:

To summarize the measures on the ballot this year, five states are ready to vote on either medical, or recreational (or both) cannabis uses.

Arizona, Montana and New Jersey will have a choice to legalize adult recreational use. Mississippi will vote on expanded medical use; currently, only Epidiolex for epilepsy patients is legal. South Dakotans will have a choice of voting on both medical and recreational use, with two cannabis related measures on the ballot.

New Jersey represents the largest possible market. It could be the first mid-Atlantic state to open recreationally. In addition to its a sizable population base, it can also draw customers from populous neighboring states with no recreational cannabis market, such as New York, Pennsylvania, Maryland, and Delaware, southern Connecticut and, even, southern states further afield.

Arizona’s recreational measure, if passed, would make it the second largest cannabis market gain this year. It is projected to add another billion dollars by 2025 to the already billion+ dollar medical market in that state. It will also bridge the gap between the recreational-legal states of the west coast and Colorado.

|

2020 Cannabis Legalization Ballot Measures |

||

| State | Ballot Measure Type | July 2019 Census Estimate |

| Arizona | Recreational | 7,278,717 |

| Mississippi | Expanded Medical | 2,976,149 |

| Montana | Recreational | 1,068,778 |

| New Jersey | Recreational | 8,882,190 |

| South Dakota | Recreational & Medical | 884,659 |

| Total | 21,090,493 | |

| Population of States Where Recreational and/or Medical Use is Currently Legal | 291,141,104 | |

Additionally, there are recreational use measures that may appear on the 2022 ballot in five more states with a total population of 32 million bringing the potential total US population where recreational use is permitted to more than 145 million in 21 states, if all the 2020 and 2022 measures pass.

Some state-level races that also merit attention this year where the candidates may have significant impact on legalization efforts and public acceptance are pointed out in an article from Cannabis Business Times. The states and their races are:

- Governorships:

- Vermont

- New Hampshire

- Senate Races:

- Minnesota

- South Carolina

- House Races:

- Florida District 1

- Texas District 17

In addition to ballot measures and candidates, legislation is pending in a dozen states to legalize recreational or medical use. Most recently, Vermont’s bill regulating the commercial sale of cannabis went into effect without the Governor’s signature on October 7, 2020, anticipating permitted commercial sale in 2022.

Hemp industry participants noted that the H.R.8337, the Continuing Resolution signed into law on October 1 extended the sunset of the 2014 Pilot Program for growing hemp until September 31, 2021. The USDA’s Status of State and Tribal Hemp Production Plans shows that as of September 11, 2020, 29 states now have approved plans, eleven have plans under review, five are using producer license provided by the USDA and two are continuing to use the 2014 Pilot Program. Idaho’s is pending state legislation and the others are preparing or resubmitting plans for reviw.

The follow-on articles in this series will address the implications for local and multistate operators (MSOs) as well as investors as they prepare for the growth opportunities in the hemp and cannabis sectors including:

- Hemp industrial production including cultivation, integrated pest management, and wildlife implications

- Hemp and cannabis biomass feedstock processing and management at scale

- Offtake agreements in the hemp and cannabis world

- Navigating the complexity of rules and regulations at the local, county and state levels regarding business structure, land use, zoning and licensing

- Scaling-up technology and operations for efficiency, volume, and product line expansion.

- Establishing feedstock supply strategies in anticipation of the impact of changing economic and climate conditions in the supply chain

- Navigating different competitive landscapes from product development and distribution standpoints

Next Up: “An Introduction to Industrial Hemp Production: Cultivation and Management,” by Dr. Susan Rupp.

About the author: Martin Wahl is V.P. of the Hemp & Cannabis Section at Lee Enterprises Consulting, the world’s premier bioeconomy consulting group, with more than 150 consultants and experts worldwide. The opinions expressed herein are those of the author and do not necessarily express the views of LEC.

Have some questions?

Not sure where to start?

Let's start a conversation. We're here to help you navigate

the bioeconomy with confidence.