Transitioning to the New BioRefining Era & Future Vision for Ethanol Plants

Transitioning to the New BioRefining Era & Future Vision for Ethanol Plants

by Joel Stone, EVP, LEC Partners

Many of those who have listened to me talking about the transition to a bioeconomy, have heard and seen my presentations regarding the use of existing bioethanol infrastructure and facilities to be expanded into producing an array of value-added products. A unique and affordable bolt on technology offered by Catalyxx (www.catalyxxinc.com) is available now and can offer options and opportunities to the present and post Covid ethanol infrastructure to expand and create new sustainable solutions.

New life for ethanol plants!

When I started working in the ethanol industry more than 40 years ago, we were just a few companies trying to survive in a market where ethanol was at less than $0.80/gal. This industry was able to fight against the odds and not only survive but flourish in a market where our customers were our competitors. The ethanol industry expanded from 2.3 Billion gallons per year in 2003 to over 14 Billion by 2009 and over 15 Billion today. Innovations and commitment to renewable fuels created that expansion and it actually provided a solid foundation to future biorefinery innovations. Ethanol producers were able to innovate and build very efficient facilities, expand production, and North America has become the largest world ethanol producer by far. We are used to fighting and winning battles. We have now entered a new inflection point for new innovations and opportunities that we can and will embrace.

More efficient cars, introduction of electric vehicles, and gasoline blends capped at 10% have resulted in oversupplied and shrinking markets. As a consequence, the industry has been suffering low margins, and, unfortunately, nothing shows that this situation will change in the future. The question we must raise is why use a valuable material such as ethanol to be consumed as a fuel when it can be a feedstock for higher value materials. Ethanol plants have contributed to the development of the rural economy and have sustained corn prices, reducing farmers’ dependence on governmental subsidies. Ethanol is a great product that is worth a new life other than being burnt blended with gasoline.

What if we could use ethanol as a feedstock for the production of chemicals? Can ethanol be used economically in these higher-value applications? The answer to both questions is: Yes, it can. And more importantly yes, we will.

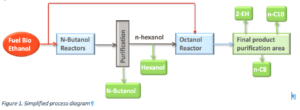

Alcohol-chemistry has been around for some years. We have already seen companies producing ethylene or ethyl-acetate from ethanol. We now can introduce a new company, Catalyxx’s proposal, that goes a step further beyond as its technology converts ethanol into higher value molecules such as n-butanol, n-hexanol, n-octanol, n-decanol, and 2-ethyl-hexanol. Just imagine facilities that are distributed across North America that can offer a range of bio based and sustainable products addressing favorable logistics and value chain advantages using the power of agricultural and renewable feedstocks.

The Process Technology

The Catalyxx process converts ethanol into higher linear alcohols by means of chemical catalysis using a proprietary and patented catalyst and process. The condensation reaction converts two molecules of ethanol into one molecule of butanol and one molecule of water. This reaction, also known as Guerbet reaction, is named after Marcel Guerbet (1861–1938). The basic reaction produces a primary alcohol product from two smaller primary alcohols. The product is a primary alcohol based on the reactants’ primary alcohol functional group. For ethanol, this product is n-butanol.

2CH3CH2OH ® C4H9OH + H2O

As the reaction proceeds stepwise, subsequent iterations of the reaction produce a variety of other alcohols depending on the reacting alcohols.

C4H9OH + CH3CH2OH ® C6H13OH + H2O

Before Catalyxx’s proprietary catalyst, the Guerbet reaction was uneconomical because it produced a large quantity of branched alcohols with no value. Today, Catalyxx technology provides very high levels of selectivity to linear alcohols.

The Background on Technology

Between 2012 and 2015, a team of engineers and chemists in Abengoa, led by Joaquín Alarcón (Founder and President & CEO of Catalyxx, Inc), worked in the development and industrialization of a catalyst, defined and modeled the reaction kinetics, described the process design and process engineering and tested the catalyst and the process for more than 30,000 hours at the laboratory, bench and pilot plant. By the end of 2014, the company was ready to start the construction of the first industrial facility in Nebraska. All the permits were in place, and the process engineering for the industrial facility was finished. Unfortunately, it didn’t happen because Abengoa entered in a difficult financial situation that finally brought the company into bankruptcy.

Since December 2019, Catalyxx has acquired the worldwide exclusive license of the technology to convert ethanol in longer chain alcohols. The technology is protected by seven patents that cover catalyst formulation, catalyst uses, and production process. Catalyxx is repurposing and upgrading the pilot plant that was used in the past and plans to have it operational in Q1 2021, with a focus on further operational efficiencies for selectivity of products and downstream recovery opportunities.

The technology is ready for commercial deployment today, and Catalyxx is pursuing to license the technology to interested parties.

Plant economics

Catalyxx believes that any new technology must be competitive in the market and be able to manufacture the products at a lower cost than the incumbent producers. The sustainability and renewable benefit offer a competitive advantage versus the incumbent fossil based products. The fact that our products can reduce greenhouse gas emissions up to 85% compared with petroleum-based products is not enough to become the leader. We must be able to produce them at the same quality and more economically.

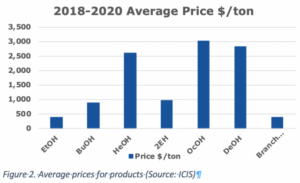

If we take as an example a plant that produces 50,000 metric ton per year of chemicals, this plant will use less than 25 million gallons of ethanol, it could generate revenues of $60 million and EBITDA of $30 million, considering 2018-2020 average prices (Figure 2).

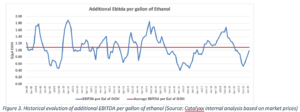

Translating these financials to EBITDA per gallon of ethanol, Catalyxx technology could have provided more than $1.00 per gallon. Looking at Figure 3, we can see the calculation month by month of the additional EBITDA contribution per gallon of ethanol processed at the Catalyxx plant.

Petrochemical n-butanol is produced in the oxo-process, where propylene reacts with syngas. In addition to n-butanol, this process provides around 10% of iso-butanol. The main component of the cost of production is propylene. Comparing month by month the cost of production of the oxo-process with Catalyxx, we can observe that over the last five years, Catalyxx was more competitive than Oxo (Figure 4) and the production margins between oxo and Catalyxx, were also very significant. The average cost of production of oxo was close to $950/metric ton vs. $320/metric ton of Catalyxx.

Catalyxx vs. ABE

Another interesting comparison is how Catalyxx competes against the ABE (Acetone-Butanol-Ethanol) route. During World War I, the ABE process was used extensively to produce acetone needed for explosives. Until the ’40s, this was the preferred route for butanol production. When Oxo-process was introduced, this technology was abandoned because butanol cost of production was much higher.

A few years ago, some companies tried to implement a modified ABE with genetically modified bacteria to produce bio-butanol. Unfortunately, those intents were not successful. The bacterial fermentation required sterile conditions that, in an industrial site, were not possible to achieve. Continuous infections and reduced production rates made this route difficult to survive. But even if it had been successful, the cost of production would have likely been higher than oxo.

With corn at $3.70/bu and ethanol at $1.30/gal, the cost of ABE butanol was $1,230/metric ton versus $375/metric ton in the case of Catalyxx.

Conclusion

The implementation of Catalyxx’s technology is a tremendous opportunity for ethanol producers that want to diversify their portfolio and enter into a much more lucrative business producing chemicals. Today’s butanol world market size is close to 5.0 million tons per year, growing at 3.5%. The market size in the US is close to 1.0 million tons/year. There is a big market to capture and ready for a new technology that is more respectful of our environment.

More on Catalyxx in “Converting Ethanol to Butanol: The Digest’s 2020 Multi-Slide Guide to Catalyxx’s Ethanol Technology” here.

About the Author

Transitioning to the New BioRefining Era & Future Vision for Ethanol Plants by Joel Stone, President of ConVergInce Advisers and serves as Executive Vice President Strategy for Lee Enterprises Consultants, the world’s premier bioeconomy consulting group. He has been a long-term visionary and respected leader in commercialization of industrial biotechnology, including ethanol plants. ConVergInce is presently providing services for fermentation and downstream recovery to develop and commercialize the emerging synthetic biology products including commercialization assistance for advanced technology clients in renewable chemicals, biochemicals, biofuels, and agricultural and biobased ingredients for food, fragrance and consumer products. Joel has twice been listed in Biofuels Digests top 100 in the bioeconomy. In 2019 he was selected as the inaugural “Champion for Industry” award from Thomas.net. To discuss matters concerning ethanol plants, Contact Joel.

See also: Ethanol Expert and Ethanol in the U.S.

Have some questions?

Not sure where to start?

Let's start a conversation. We're here to help you navigate

the bioeconomy with confidence.