Opportunities to Transition Ethanol Facilities to Biochemical Refineries

By: Daniel A. Lane and Joel A. Stone, Lee Enterprises Consulting

Opportunities to Transition Ethanol Facilities to Biochemical Refineries? The US commercial petroleum industry started with the drilling by retired railroad conductor Edwin Drake of a well near Titusville, PA in 1859. Drake’s well sparked an oil boom and over the next couple of years, and US petroleum production grew rapidly. By 1865, the first successful oil pipeline was built, from Titusville to a railroad station 5 miles away. From there, oil was transported to refineries that distilled the crude oil to produce kerosene, which had previously only been produced from coal by methods protected by patents. With the ability to bypass the patented processes and avoid paying royalties, the refining industry grew rapidly. Until the early 1900s, kerosene continued to be the primary product of the refining process; before then, refiners had considered gasoline a useless byproduct. However, with the advent of electric lighting and the rise of the automobile, refinery production shifted and by 1909, motor fuels production exceeded that of kerosene. The refining industry had made its first major transition, to multiple fuel products.

Petroleum production spread across the US and the refining industry continued to grow. As the market for gasoline grew, a shortage soon developed for the lighter fractions of crude oil. This shortage led to the development of the catalytic cracker, which breaks long hydrocarbon chains into smaller molecules. This new technology allowed refiners not only the ability to produce higher octane gasoline, but also the ability to produce more valuable byproducts, such as olefins. A petrochemicals industry was born. By the 1940s, demand for synthetic materials to replace expensive and sometimes less efficient natural materials increased dramatically and petrochemicals processing developed into an industry of its own with new companies started based upon a chemicals business model.

Consider the basics of this story: An industry starts out from humble beginnings and grows rapidly to fill market demand, replacing outdated sources. As technology advances, market demands shift and the industry shifts with it. New technologies arise in part due to this shift, and an entirely new industry forms and spins off. We propose that a reinvention of the chemicals industry offers an opportunity within the ethanol industry for the expansion of ethanol plants to renewable chemicals and materials.

Although the first use of ethanol as a motor fuel was almost 200 years ago, the ethanol industry we know today finds its roots in the 1970s, when petroleum-based fuel became expensive due to embargoes and production decreases. Corn became the predominant feedstock for this nascent industry due to its abundance and the ease with which it can be converted to ethanol. Later, as the price of oil fell – and the price of ethanol with it – subsidies were introduced to maintain production and help the US maintain a semblance of energy security. In the 90s, the need for gasoline oxygenates to reduce carbon monoxide emissions created an additional boost to demand ethanol, and the phasing out of MTBE as an octane booster in the late 90s created yet another boost. In 2005, the first Renewable Fuel Standard became law, providing for ethanol production of 4 billion gallons in 2006. MTBE was eliminated from further use as an oxygenate and octane booster in 2006 and in a parallel effort the significant growth of the US ethanol industry was well on its way. That was expanded with the Energy Independence and Security Act of 2007, which introduced the requirement that renewable fuel usage increase to 36 billion gallons annually by 2022. It’s not been easy growth for the industry, though. Price volatility for both feedstock and products has led some corn ethanol producers to bankruptcy. In 2011, subsidies for the production of corn ethanol were eliminated. The renewable fuel standard has limited corn ethanol to only 15 billion of those 36 billion gallons. In the same amount of time it took for the petroleum refiners to transition primary markets, the corn ethanol industry is looking at the need to do the same as it seeks continued growth.

As with our petroleum refining industry story, the fuel ethanol industry has seen a demand shift. In today’s case, it’s not to a different product from the same feed, but instead the need to use a different feed to produce the same product. However, producers limited to the same feed have the opportunity to change production to renewable chemicals. The latest RFS calls for 21 billion gallons of advanced biofuels, and technologies to produce cellulosic ethanol and other advanced biofuels have arisen to meet this demand. Along the way, technologies have been created or adapted to produce chemicals such as organic acids, alcohols, and olefins. These are collectively considered renewable chemicals.

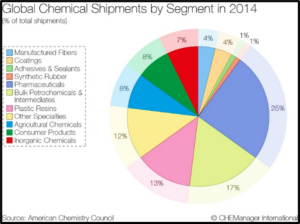

The renewable chemicals industry is emerging as a subset of a $450 billion specialty chemical market as shown in Fig. 1. within a $5.4 trillion global chemical market (IHS 2014 market data). The breadth of market segmentation and reach into branded product categories offer numerous avenues for product acceptance. The development of renewable chemicals spans a variety of markets, including coatings, food additives, adhesives, surfactants, and specialty polymers. The $5.4 trillion Global Chemicals Market spans many market sectors as reported by the American Chemical Council as shown in Fig. 2.

| Figure 1 | Figure 2 |

There has been much support for the production of chemicals from renewable sources as reported by the USDA and DOE/NREL, starting with a 2004 DOE/NREL report on the top 12 value-added chemicals from biomass. That report identified 12 building block chemicals produced from sugars via biological or chemical conversions and they can subsequently be converted to several high-value bio-based chemicals or materials. An updated report was released by DOE/NREL that modifies that list after considering the current potential to accelerate these chemicals to market. The updated list of chemicals includes:

- Four carbon 1,4-diacids (succinic, fumaric, and malic)

- 2,5-Furan dicarboxylic acid (FDCA)

- 3-Hydroxy propionic acid (3-HPA)

- Aspartic acid

- Glucaric acid

- Glutamic acid

- Itaconic acid

- Levulinic acid

- Hydroxybutyrolactone

- Glycerol

- Sorbitol (sugar alcohol of glucose)

- Xylitol/arabinitol (sugar alcohols from xylose and arabinose)

These chemicals are all identified as having a Technology Readiness Level (TRL) of 6 or better, meaning the manufacturing process has already been tested at an engineering/pilot scale. Two-thirds of them have a TRL of 9 (tested at full production scale) when using commodity feedstocks such as starch or sugar. More than half have publicly disclosed ongoing R&D for the use of lignocellulosic feedstocks, but what is key is that a number of them have been demonstrated at a commercial scale using commodity sugars such as dextrose that would be corn or biomass-derived.

As the corn ethanol industry looks for growth opportunities outside of fuel ethanol, renewable chemicals are an opportunity in the reinvention of the chemical industry and the progression to biorefineries. Many existing corn facilities already make dextrose, which is a perfectly acceptable feedstock for many of these processes. Other facilities can be retrofitted with equipment to produce clean sugar streams that can feed these processes. However, by just producing the sugars, manufacturers leave others the opportunity to produce and sell these high-value chemicals; that’s not the transition these facilities should be considering. They need to be considering what it would take to convert from an ethanol refinery to a biochemical refinery.

While there is much to consider when looking at a transition to biochemicals; ethanol refineries can start by considering strategies for reducing the risk of adding or changing products, such as requiring solid laboratory and bench chemistry development, rigorous pilot scale development and replication testing, and a well-considered capital budget that includes a FEL3-level estimate. These strategies come from lessons learned across the industry and highlight why there have been many failures in the past. While it is tempting to rush to market by shortcutting lab, pilot, and demo plans, or by presenting unrealistic FEL3 designs, these approaches have often led to failures in the past and a wise would-be biochemical refiner will avoid technologies that exhibit these tendencies. Collaborations between existing ethanol businesses and renewable chemical startups would offer a natural progression to a healthy renewable chemicals business platform.

When looking at potential biochemical technologies, ethanol producers need to consider three types of opportunities: Full repurposing of the facility, partial repurposing (e.g. 2 out of 8 fermenters), and bolt-on technologies. Repurposing the facility would include a complete transformation of existing unit operations and the addition of new processes to maximize the existing ethanol assets to the fullest extent. An example of such an approach is the Green Biologics repurpose in Little Falls, MN. A complete repurpose would likely be limited to facilities smaller than 50 MMGPY. Partial repurposing could make sense where an existing plant layout would offer advantages to use existing fermentation capacity and on-site utilities to divert corn grind capacity to a renewable chemical. In many cases a fiber fractionation could be included with a clean sugar technology installation to increase the overall corn yield to ethanol and valuable specialty chemicals. Bolt-on approaches would likely be deployed in 100MGPY or larger facilities where a portion of the grinding capacity could be diverted to a renewable chemical processing plant co-located with the ethanol plant that would include increasing ethanol conversion efficiencies by optimizing ethanol yield with slower run rates while obtaining the diversification of higher-value specialty chemical manufacture.

With bolt-on technologies, ethanol producers need to look at facility and energy infrastructure to see whether there is an existing capacity to install these technologies. For example, even a small bolt-on fermentation process may require more cooling capacity than available, especially during the summer months. Producers also need to consider what upstream modifications may be required to produce a clean feedstock for the bolt-on process. These upstream modifications to produce clean sugar streams for renewable chemical products are available today. Downstream separations and purification processes will likely be needed for the bolt-on, and there are numerous proven technologies available.

Finally, ethanol producers could consider licensing versus collaboration models. Some technologies, such as Genomatica’s, are far enough along commercially that producers can license the technology and produce and sell 1,4-butanediol on their own. Others, such as Green Biologics, BioAmber, or GreenYug, are likely approached as a collaboration wherein the ethanol producer provides sugars or ethanol for the commercial process and both parties have equity stakes for sharing in the profitability of the renewable chemical revenue stream.

In conclusion, during the reinvention of the chemical industry, we will find numerous opportunities for corn ethanol producers (and biomass conversion facilities) to make the transition from producing fuel ethanol to producing high-value renewable biochemicals in addition to ethanol, or if they so choose as an alternative to ethanol. Whatever the case, we will find a path forward that will follow the same transition that was experienced with petroleum refining moving toward petrochemical refining. The acceleration of synthetic biology that is occurring will allow technology to progress much like catalytic cracking and processing grew the petrochemical complexes of today.

About the Authors: This article, originally published in 2017, is by Daniel Lane and Joel Stone, members of Lee Enterprises Consulting, the world’s premier bioeconomy consulting group, with more than 150 consultants and experts worldwide who collaborate on interdisciplinary projects, including those requiring the technologies discussed in this article. The opinions expressed herein are those of the authors and do not necessarily express the views of Lee Enterprises Consulting.

Have some questions?

Not sure where to start?

Let's start a conversation. We're here to help you navigate

the bioeconomy with confidence.